michigan gas tax increase

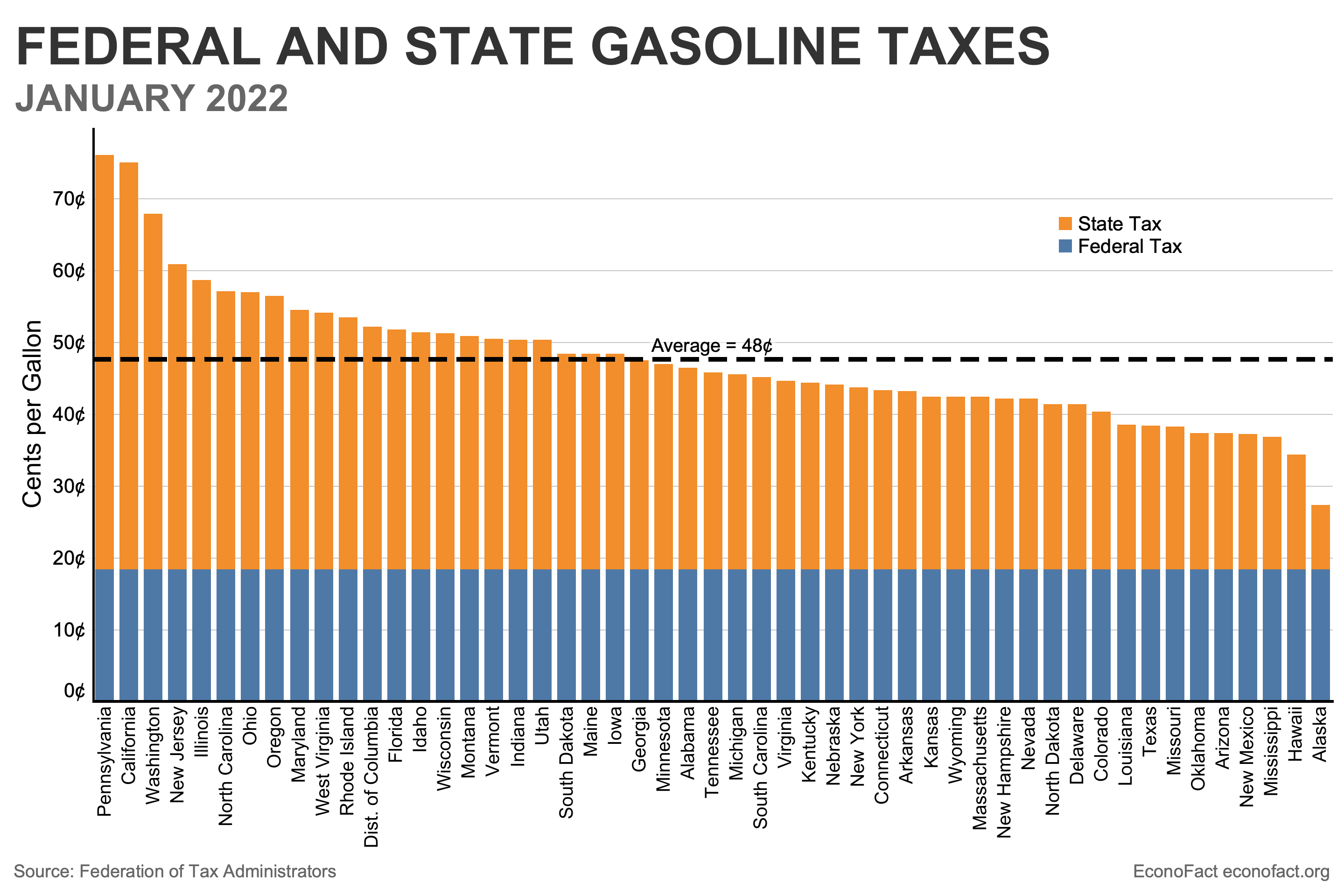

For fuel purchased January 1 2022 and after. Savings would increase should the federal gas tax be eliminated as Whitmer and other governors have called for a levy.

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Diesel Fuel 263 per gallon.

. Alternative Fuel which includes LPG 263 per gallon. 0183 per gallon. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

To give some relief to Michigan motorists on Wednesday the state House approved a pause of Michigans 27-cent-a-gallon gas tax for the next six. As inflation increases Whitmer sent a letter to lawmakers on Thursday calling for her new MI Tax. Heres what MDOT says on the issue.

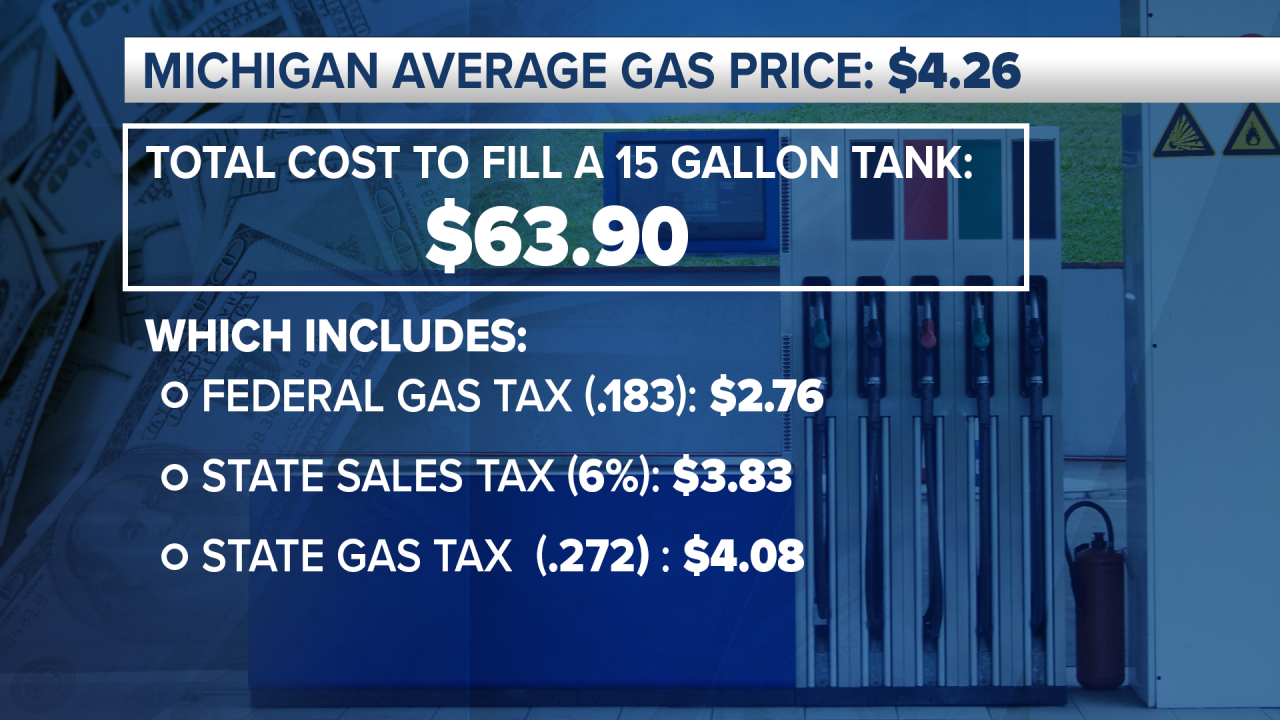

Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a. The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by the website 247 Wall St. Federal excise tax rates on various motor fuel products are as follows.

An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon. The Michigan Public Service Commission today approved an 84173000 rate increase for DTE Gas Co. And Michigan with a gas-tax diversion rate of 339 is ranked with New Jersey as the third highest GTDR in the nation.

A proposed hike was defeated by an 80-percent-20-percent margin. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. For fuel purchased January 1 2017 and through December 31 2021.

In the past week Michigan gas prices have risen to an average of 425 a gallon for regular gas. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well. The Russian invasion of Ukraine and a new ban on Russian oil imports have spurred the price spike.

1 2020 and Sept. Currently Michigans fuel excise tax is 263 cents per gallon cpg. It will have a 53 increase due.

The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. For fuel being sold at 3 per gallon drivers would save 18 cents per gallon. Michigan Governor Gretchen Whitmer D this week released her fiscal year FY 2020 budget bill central to which is a 45-cent gas tax increase and a new entity-level tax on unincorporated businesses.

That includes a roughly 1. Liquefied Natural Gas LNG 0243 per gallon. Under the governors proposal a 45-cent increase would occur in three.

Increase the prices of oil and gasoline between 1999 and 2008. So far in 2021 inflation has been unusually high. Gretchen Whitmer calls for nearly tripling per-gallon gas tax which would make the state home to the countrys highest fuel taxes By DAVID EGGERT Associated Press March 5 2019 10.

That is a responsible first step in ensuring that our roads are properly funded Whitmer proposes a 45-cent-per-gallon gas tax increase phased in over a year that would raise about 25 billion for roads. Gas taxes Created Date. Gasoline 272 per gallon.

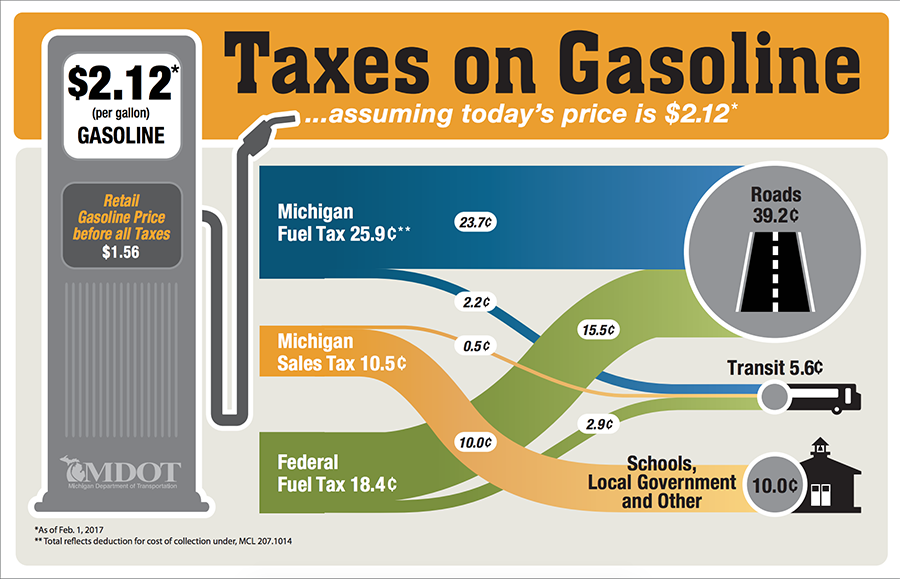

The same three taxes are included in the retail price on diesel although the Federal diesel fuel tax rate is 244 cents per gallon. Gasoline 263 per gallon. 52 rows The current federal motor fuel tax rates are.

The current state gas tax is 263 cents per gallon. This chart shows the relative size of historic gasoline tax increases in Michigan Author. Inflation Factor Value of Increase Percentage.

The Michigan gasoline tax 263 cents per gallon. Gretchen Whitmer wants to send 500 to Michigan families right away. As shown in Figure 3 during 2018.

10172019 105048 AM. The global slowdown in growth that. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

Most jet fuel that is used in commercial transportation is 044gallon. 4198 cents per gallon 140 greater than national average 2021 diesel tax. The increase is capped at 5 even if actual inflation is higher.

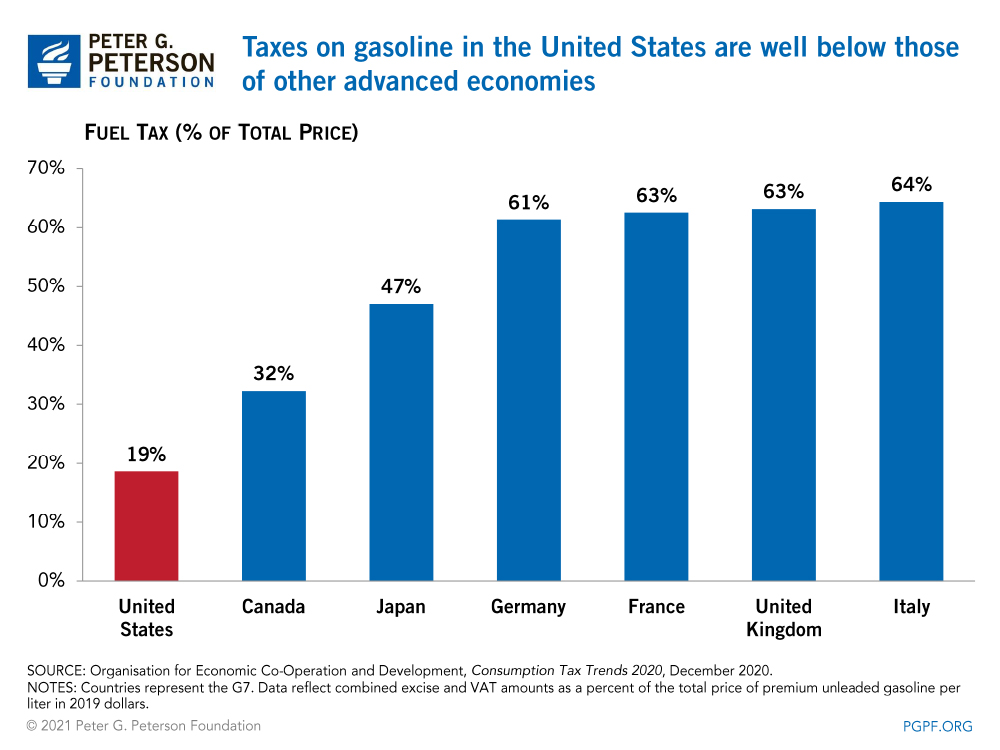

And the states gas tax as a share of the total. As of January of this year the average price of a gallon of gasoline in Michigan was 237. Voters in Michigan have rejected a proposal to increase gas taxes in their state to help pay for transportation projects the.

The 187 cents per gallon state gas tax and the 184 cents per. Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation. We can shift out the sales tax at the pump and replace it with a revenue-neutral gas tax Chatfield told reporters Thursday.

Diesel Fuel 272 per.

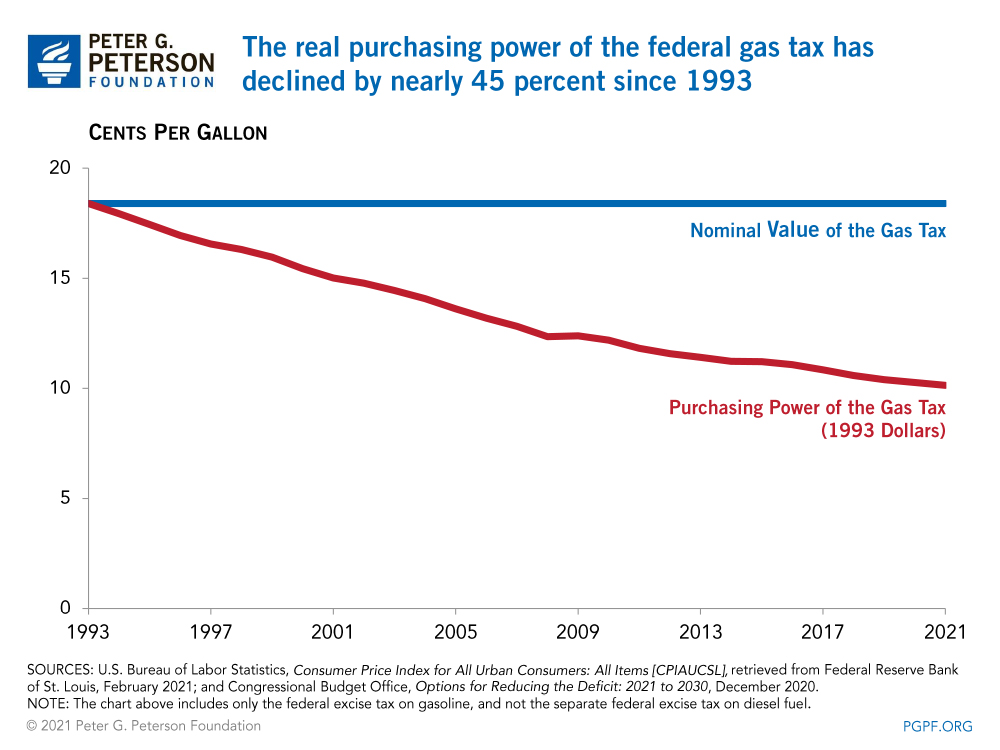

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Missouri S First Gas Tax Increase Since The 1990s Goes Into Effect Friday Gas Tax Missouri Jefferson City

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Most States Have Raised Gas Taxes In Recent Years Itep

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Michigan Gas Tax Calculator Michigan Petroleum Association

.png)

Map State Gasoline Tax Rates Tax Foundation

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Where The Money Goes Road Commission For Oakland County

Michigan Gas Tax Going Up January 1 2022

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan